Movement Reference Number (MRN)

What Is the Single Administrative Document (SAD)?

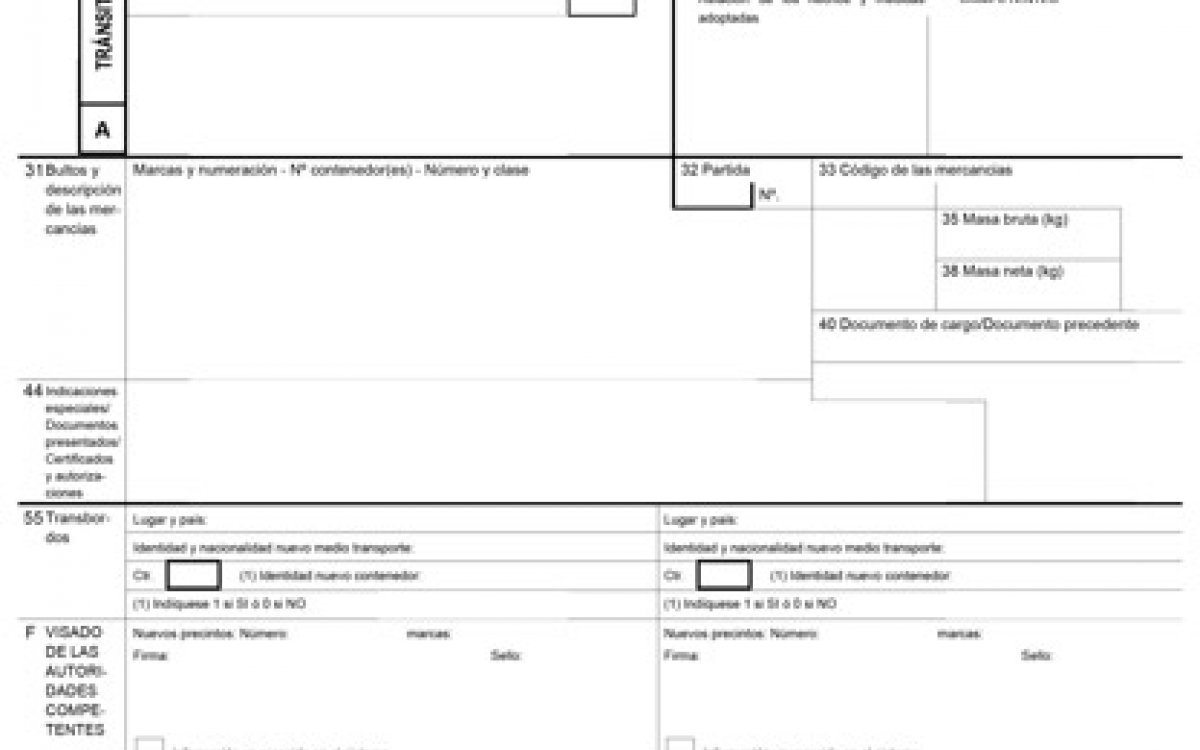

It is an official document used in international trade to declare goods to customs.

When it comes time to cross a border, customs will require your goods to have a properly completed SAD.

Why Is the SAD Important in International Trade?

In addition to being essential for successful transportation, it is also necessary for tax declaration, as this document includes crucial information about the goods you are transporting.

Its function varies slightly depending on the type of goods exchange and consists of nine sheets or copies, which are used for different operations.

It contains information such as import data, goods descriptions, tariff codes, values, and the country of origin/destination.

How to Fill Out the SAD Correctly?

Depending on the type of transport you are performing, you will need to complete different copies.

- For transit operations, such as transshipments, you must complete form 1 for the customs of departure, 4 for the customs of destination, and 5 if the goods must be returned to their place of origin.

- If you are importing goods, you must complete forms 6 and 8 for the customs of importation and the recipient, respectively.

- If, on the other hand, you are exporting goods, you must present form 1 for the customs of departure, form 3 for the recipient, and form 4 if it is necessary to justify the community status of the goods at the customs of destination.

The four channels through which customs can process goods are:

- Green: The documentation is correct, and the goods can be transported within or outside the country.

- Orange: You must review the goods' documentation.

- Yellow: You need to verify the existence of the goods and validate the certificate after a border inspection.

- Red: You must verify both the documentation and the goods, as the processing was not carried out correctly.