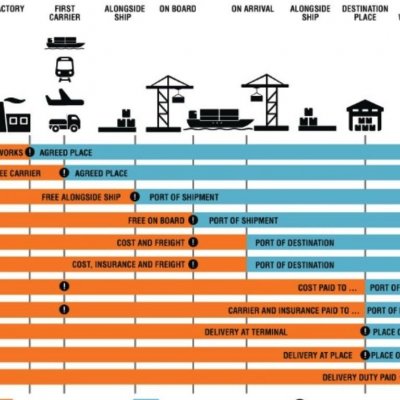

INCOTERMS 2020

Every trade operation with an international scope owes its origin to the contract between the person who imports and the person who exports. Said contract stipulates a series of legal and practical clauses that allow the commercial activity that is to be carried out to be regulated in a stipulated manner. And in this framework, is where the Incotermos 2020 come into play.

What are Incoterms 2020?

Incoterms 2020 are a series of standards created by the International Chamber of Commerce and followed throughout the international framework. They establish rights and obligations between buyer and seller, establishing how cost and risk are allocated between the exporter and importer during their commercial activity.

Incoterms® are rules created by the ICC (International Chamber of Commerce), internationally recognized, that define rights and obligations between buyer and seller and establish how the costs and risks will be allocated between the different parties of a transaction.

Incoterms types:

In Factory or Ex Works, the seller is only responsible for delivering the goods to its own or external facilities designated by it. Buyer bears all risk from there to destination.

FCA - Free Carrier - Free Carrier (+ agreed place of delivery) "Free Carrier"

FCA is when the seller delivers the merchandise to the carrier (the person responsible for carrying out the freight) or to another person designated by the buyer at the seller's premises or in another agreed place.

FCA (Free Carrier) is an Incoterm that stands for Free Carrier (named place). It describes the responsibilities of both the seller and the buyer in an international transaction, specifically with regard to delivery and risk transfer. Here is a detailed explanation of how the FCA works:

Seller's responsibilities:

He must deliver the goods to the carrier or other party designated by the buyer at the agreed place (such as the seller's premises, a warehouse or a terminal).

He is responsible for export customs clearance, including obtaining any necessary licences or documentation.

If delivery takes place at the seller's premises, the seller is responsible for loading the goods onto the buyer's transport. If delivery occurs elsewhere (such as at a transport terminal), the seller delivers the goods without unloading them.

Responsibilities of the buyer:

He is responsible for the costs and risks once the goods have been handed over to the carrier.

He is responsible for arranging transport after the seller hands over the goods to the carrier.

He is responsible for import customs formalities, duties and any other transport costs to the final destination.

Risks and costs:

Risk Risk passes from the seller to the buyer from the moment the goods are handed over to the carrier, either at the seller's premises or at another agreed place.

Costs The seller bears the costs of delivering the goods to the named place and the export duties. The buyer bears the costs thereafter, including transport and insurance.

Suitable for all modes of transport:

FCA is suitable for any mode of transport (air, sea, road, rail or multimodal).

Key points:

Location flexibility: The FCA allows the buyer to choose a carrier and decide where he wants the goods to be delivered (at the seller's premises or elsewhere).

Insurance: The FCA does not oblige the seller to provide insurance. However, the buyer may choose to insure the goods once the risk has passed.

Practical example:

If a buyer in Germany purchases goods from a seller in China under the terms of the FCA, the seller delivers the goods to a carrier in Shanghai. Once the goods have been handed over to the carrier (and cleared for export), the risk passes to the buyer, who is responsible for transport to Germany and bears all costs and risks after delivery of the goods.

The FCA is one of the most flexible and widely used Incoterms, especially for containerised shipments.

CPT Carrier Paid To - Carriage paid to (+ agreed place of delivery) "Carriage Paid To"

CPT is when the seller delivers the merchandise to the carrier (the person responsible for carrying out the carriage) or to another person designated by the seller at an agreed place.

CPT (Carriage Paid To) is an Incoterm that stands for Carriage Paid To (named place of destination). It is used in international trade to define the responsibilities of the seller and buyer regarding the transportation of goods. Here's a breakdown of how CPT works:

Seller's Responsibilities:

The seller is responsible for delivering the goods to a carrier at an agreed-upon location.

The seller must pay for the carriage of the goods to the named destination (the buyer's country or a mutually agreed-upon place).

The seller is responsible for export customs clearance and formalities in the country of origin.

Buyer's Responsibilities:

The buyer is responsible for any risks and costs that occur after the goods are handed over to the carrier, including insurance, unloading, and import customs clearance.

The buyer takes on the risk of loss or damage to the goods as soon as the seller delivers the goods to the carrier.

Risk and Cost

Risk: The risk passes from the seller to the buyer when the goods are handed over to the first carrier. Even though the seller pays for transportation, the risk lies with the buyer from the moment the goods are given to the carrier.

Cost: The seller covers the cost of transporting the goods to the destination, but the buyer covers any additional costs (e.g., import duties, unloading, and final delivery).

Key Points:

Insurance: Unlike the CIP (Carriage and Insurance Paid To) Incoterm, the seller is not obligated to provide insurance under CPT. If insurance is required, it is the buyer's responsibility.

Suitable Transport: CPT can be used for any mode of transport, including air, sea, road, or multimodal transport.

This Incoterm is often used in transactions where the seller arranges transportation, but the buyer is willing to take on the risks of the goods earlier in the journey.

CIP - Carrier and Insurance Paid To - Transport and Insurance paid to (+agreed place of delivery)

CIP The seller pays the transport to the agreed destination, but delivers the goods to the buyer (with transfer of risk) placing them in the possession of the carrier contracted by said seller.

CIP (Carriage and Insurance Paid To) is an Incoterm that stands for Carriage and Insurance Paid To (named place of destination). It describes the responsibilities of both the seller and the buyer in an international trade transaction, with a specific focus on carriage and insurance. Here is a detailed breakdown of how CIP works:

Seller's responsibilities:

He must arrange and pay for the carriage of the goods to the agreed destination (agreed by both parties, usually in the buyer's country).

He is responsible for export customs clearance and all related formalities.

You must take out a minimum insurance for the goods, covering the risks until the goods arrive at the agreed destination. The insurance must cover at least 110% of the value of the goods, as defined in the contract.

Deliver the goods to the first carrier (at the agreed place), at which point the risk is transferred to the buyer.

Buyer's responsibilities:

He is responsible for risks and costs occurring after delivery of the goods to the carrier, although the seller provides basic insurance cover to the destination.

He is responsible for import customs clearance, duties and any other transport costs on arrival at destination.

Risks and costs:

Risks Risk passes from the seller to the buyer when the goods are delivered to the first carrier, although the seller is responsible for insurance and carriage.

Costs: The seller covers the cost of transport and insurance to the named destination, but the buyer bears any other costs (e.g. import duties, additional transport beyond the named destination).

Key points:

Insurance requirement: unlike CPT (Carriage Paid To), under CIP, the seller is obliged to provide insurance, but only up to the minimum coverage required under the Institute Cargo Clauses (C). The buyer may request additional coverage, but this must be explicitly agreed.

Multimodal transport: CIP is suitable for any mode of transport, including air, rail, road, multimodal or sea transport.

Example:

If a buyer in the UK purchases goods from a seller in Japan on CIP terms, the seller arranges for the goods to be transported to a specified place (e.g. a port in the UK) and insures the goods during transit. Once the goods are delivered to the first carrier in Japan, the risk is transferred to the buyer, but the seller continues to bear the transport and insurance costs until the goods arrive at the agreed destination.

Summary

Costs: The seller covers the costs up to the destination.

Risks: The buyer bears the risks once the goods have been handed over to the first carrier.

Insurance: The seller provides insurance for the goods during transport, but it is the buyer's responsibility if he wants additional insurance.

DAP - Delivered at Place - Delivered at place (+ agreed place of delivery) "Delivered at Place"

DAP is when the seller delivers the merchandise, with transfer of risk, when it is made available to the buyer in the means of transport prepared for delivery. unloading at the agreed place of destination.

DAP (Delivered at Place) is an Incoterm that stands for Delivered at Place (named place of destination). It defines the responsibilities of both the seller and the buyer in an international trade transaction, specifically regarding the delivery of goods. Here's how DAP works:

Seller's Responsibilities:

He is responsible for delivering the goods to the named destination (which can be the buyer's premises, a warehouse, or other location in the buyer's country).

He assumes all risks and costs involved in transporting the goods to the named place, including export customs clearance, shipping, and delivery.

He does not need to unload the goods at the destination, unless otherwise agreed.

He is not responsible for import customs clearance, duties, or taxes in the buyer's country.

Buyer's Responsibilities:

He is responsible for unloading the goods at the named place.

He is responsible for import customs clearance, duties, taxes, and any other formalities or costs in the destination country.

Risks and costs

Risks: Risk passes from the seller to the buyer when the goods are available for unloading at the named destination.

Costs: The seller covers all transport costs until the goods reach the named destination, but the buyer bears costs related to unloading and any import customs duties or taxes.

Key points:

Unloading: The seller is not responsible for unloading the goods. This is an important distinction because unloading can involve significant costs and, under the DAP, this is explicitly the buyer's responsibility.

Customs and duties: The buyer is responsible for import clearance, which includes customs duties, VAT and other taxes.

Suitable for all modes of transport:

The DAP can be used for any mode of transport, including land transport, rail, air, sea or multimodal transport.

Example:

If a seller in China agrees to deliver goods to a buyer in France under the terms of the DAP, the seller arranges the transport and assumes all risks and costs until the goods arrive at the buyer's warehouse in France. Once the goods arrive, are available for unloading at the warehouse, the risk is transferred to the buyer. The buyer then handles unloading, customs clearance, and pays any applicable import duties and taxes.

DAP Summary:

Costs: The seller covers the costs of transport to the destination, while the buyer handles unloading and import duties.

Risks: The seller bears the risk until the goods reach the destination.

Customs: The buyer is responsible for import customs clearance and associated costs.

Delivered at Place Unloaded (DPU) – Merchandise delivered and unloaded at the agreed place.

DPU The Incoterm® DPU (Merchandise delivered and unloaded at the agreed place of delivery) establishes that the seller delivers the merchandise, with transfer of risk, when it, once unloaded from the means of transport, is made available to the buyer at the place of delivery. agreed destination.

DPU (Delivered at Place Unloaded) is an Incoterm that stands for Delivered at Place Unloaded. It defines the responsibilities of both the seller and the buyer in an international trade transaction, specifically regarding the delivery and unloading of goods. Below is a detailed explanation of how DPU works:

Seller's Responsibilities:

He is responsible for delivering the goods to the named destination and unloading them at that location.

He assumes all costs and risks involved in transporting and unloading the goods at the named place.

He is responsible for export customs clearance and any necessary formalities in the country of origin.

He is not responsible for import customs clearance, duties or taxes in the country of destination.

Buyer's Responsibilities:

The buyer is responsible for import customs clearance, duties, taxes and any other formalities in the destination country.

Once the goods are unloaded at the designated place, the buyer assumes all risks and costs related to the goods.

The buyer is responsible for any additional transportation costs beyond the designated place if onward delivery is required.

Risks and Costs:

Risks: Risk is transferred from the seller to the buyer only after the goods have been unloaded at the designated destination.

Costs: The seller covers all transportation and unloading costs to the designated destination, while the buyer is responsible for import duties, taxes and any transportation or handling after unloading.

Key Points:

Responsibility for unloading: One of the most important aspects of DPU is that the seller is responsible not only for delivering the goods, but also for unloading them at the destination. This makes DPU unique compared to other Incoterms such as DAP (delivered at place), where the buyer is responsible for unloading.

Customs and duties: The buyer is responsible for import customs clearance and payment of any associated duties or taxes.

Suitable for all modes of transport:

DPU can be used for any mode of transport, including sea, air, road, rail, or multimodal transport.

Example:If a seller in Germany sells goods to a buyer in Canada under DPU terms, the seller must arrange and pay for the transport and unloading of the goods at the buyer's warehouse or other designated location in Canada. Once the goods are unloaded at the warehouse, the risk passes to the buyer, who then handles customs clearance and import duties.

DPU Summary:

Costs: The seller covers the costs of transport and unloading, while the buyer handles import duties and other post-unloading costs.

Risks: The seller bears the risk until the goods are unloaded at the designated location.

Customs: The buyer is responsible for import customs clearance and associated costs.

DPU provides a high level of service from the seller, as the seller handles the entire transport process, including unloading, which is not typical of most other Incoterms.

DDP - Delivered Duty Paid - Delivered Duties Paid (+agreed place of delivery).

DDP "Delivered Duties Paid" is when the seller delivers the merchandise, with transfer of risk, when it is made available to the buyer cleared for import in the means of transport ready for unloading at the agreed destination.

DDP (Delivered Duty Paid) is an Incoterm that means the seller pays all expenses, including import customs expenses, until the merchandise is delivered to the agreed point in the destination country, with the buyer not carrying out any formalities.

Here's how DDP works:

Seller Responsibilities:

The seller takes care of all customs formalities and pays all duties and taxes

Buyer Responsibilities:

The buyer will be responsible for paying for the merchandise as agreed. Additionally, it would be advisable to help the seller in case he or she needs an import license. Additionally, the seller is responsible for choosing the place and date for delivery.

Risks and costs

Risks: Buyers benefit greatly from DDP because they assume fewer risks, responsibilities and costs. While DDP is a good deal for the buyer, it can be a huge burden for the seller because it can quickly reduce profits if handled incorrectly.

Costs: Under this term, the seller assumes all responsibilities and costs associated with the transportation of the goods, including import duties, taxes and other charges until the goods are completely delivered to the place agreed with the buyer.

Key points:

The seller must make the goods available to the buyer at the agreed place (the buyer's factory, a warehouse, etc.), in addition to covering all associated costs, including the unloading of the goods and customs procedures and costs.

Suitable for all modes of transport: The DDP rule can be applied to all modes of transport.

An example would be that the exporter must assume all expenses until the merchandise reaches its destination; that is to say; collection at origin, export clearance, expenses at port/airport/point of origin, sea/air/land freight to port/airport/point, import clearance, tariffs, taxes and delivery to the importer's home.

FAS - Free Alongside Ship - Free Alongside Ship (+ agreed place of delivery) "Free Alongside Ship"

FAS is when the seller delivers the merchandise to the buyer when the merchandise is placed alongside the vessel (or barge) designated by the buyer at the port of shipment.

FAS (Free Alongside Ship) is an exclusive maritime transport incoterm. Under the FAS incoterm, the seller must leave the goods next to the ship at the dock and is responsible for all costs and risks until the goods have been placed at this location.

Here's how FAS works:

Seller Responsibilities:

The seller is responsible for keeping the goods in good condition until the moment of delivery to the buyer. This implies taking all necessary measures to maintain the quality and functionality of the property, avoiding its deterioration or damage.

Buyer Responsibilities:

Pay the price of the merchandise agreed in the sales contract. · Hire and assume the cost of operations.

Risks and costs

Risks:

The FAS rule does not require either the seller or the buyer to take out insurance to cover the possible risks that merchandise may suffer during transportation.

Costs: Pay the price of the merchandise agreed in the sales contract. Hire and assume the cost of cargo operations at the port of shipment.

Key points:

It implies that the seller has to deliver the cargo at the dock and under the enabled crane.

Suitable for all modes of transport:

It is an exclusive incoterm for maritime transport.

From this point, the risk is assumed by the buyer. The key difference between FAS and FOB lies in the place of delivery of the goods. While in FAS the delivery is made alongside the ship at the port of shipment, in FOB the delivery is made on board the ship in the same port.

FAS Summary:

This Incoterm is used exclusively in maritime transport, whether by inland navigable or maritime routes. Under the FAS incoterm, the seller must leave the goods next to the ship at the dock and is responsible for all costs and risks until the goods have been placed at this location.

FOB - Free On Board - Free on Board (+agreed place of delivery) .

FOB"Free on Board" is when the seller delivers the goods on board the ship designated by the buyer at the port of shipment. The exporter will be responsible for the expenses and responsibilities until the place that has been decided.

FOB (Free on Board) is a type of Incoterm, through which the selling party, through a purchase and sale, is responsible for the costs that may occur throughout the process that is carried out until the merchandise being marketed is left at the port of origin or departure.

Here's how FOB works:

Seller Responsibilities:

The seller is responsible for taking the goods to the port of shipment and loading them on the ship designated for export. Buyer's responsibilities:

Once the goods have crossed the ship's rail, that is, once they are on board the ship, responsibility passes to the buyer.

Risks and costs

Risks:

The buyer transfers the risk to the seller once the goods have been loaded on board the ship. This makes FOB inappropriate for transporting cargoes that travel in containers, which are often delivered to the terminal several days before loading.

Costs: Costs prior to shipment of the merchandise on the ship that will transport it. They include: Inland: land transportation to the loading port. Reception, hauling and loading on the vessel, generally carried out by the shipping company's agent.

Key points:

The formula to calculate the FOB incoterm is the following. The first step is to know what the total cost of the export is (the CIF must be included). Subsequently, you must divide that figure by 1, subtracting the sum of the indirect expenses and the profit.

Suitable for all modes of transport:

It is used exclusively for sea or river transport.

Example: Fob Barcelona, the exporter must assume the cost of collection and delivery at the port/airport/point in Barcelona, expenses at origin (port terminal/airport handling/point in the case of land) and export clearance.

FOB Summary:

This Incoterm is used exclusively in maritime transport, whether by inland navigable or maritime routes. FOB states that the seller is responsible for bringing the goods to the port of shipment and loading them on the ship designated for export

CFR - Cost and Freight - Cost and Freight (+agreed place of delivery).

CFR“Cost and Freight” is when the seller assumes the cost and freight, duties not paid, to the agreed port of destination. In this case, the exporter must assume all expenses until the port/airport/arrival point at destination.

CFR (Cost and Freight) for its acronym in English, is an exclusive maritime transport incoterm. It means that the seller is responsible for delivering the goods to the port specified by the buyer, as well as booking and paying for the transportation of the goods to the port of destination.

Here's how CFR works:

Seller Responsibilities:

The seller is responsible for delivering the goods to the port specified by the buyer, as well as arranging and paying for the transportation of the goods to the port of destination.

Buyer Responsibilities:

The buyer's responsibility only lies in the import clearance and unloading. In this incoterm, there is no obligation to take out insurance.

Risks and costs

Risks:

The risk is transferred when the goods are loaded on board the vessel at the port of origin. Therefore, this incoterm should be used only in those situations where there is direct access to the ship, such as in bulk cargo shipments.

Costs: All costs, including freight, that are necessary to transport the merchandise to the agreed port of destination. It does not include the cost of unloading the merchandise from the ship at the port of destination.

Key points:

Term used in maritime transport, expressing that the seller is responsible for all costs, including the main transport, until the merchandise reaches the port of destination, although the risk is transferred to the buyer at the time the merchandise is found. loaded at the agreed point.

Suitable for all modes of transport:

The Incoterm CFR is exclusive to maritime transport.

That is, you must assume collection and delivery at the airport/port, in the case of land to destination, export clearance, local expenses at the terminal of origin, freight (sea/air/land) and your responsibility ends at the port/airport. /destination point.

CFR Summary:

The seller must clear the goods for export, deliver them on board the vessel at the port of departure, and pay for the transportation of the goods to the designated port of destination.

CIF - Cost, Insurance and Freight - Cost, Insurance and Freight (+agreed place of delivery).

CIF With the CIF Incoterm®, the seller bears the cost of insurance and freight, duties not paid, to the agreed port of destination. The CIF is the same as the CFR with the difference that it includes insurance. The insurance of the goods must be done before collecting the goods and in this case it will cover up to the port/airport or point of destination.

CIF (Cost, Insurance and Freight) the seller has the same obligations as low cost and freight (CRF), but must also acquire marine insurance that covers the buyer's risk of loss or damage to the goods during transportation.

Here's how CIF works:

Seller Responsibilities:

The seller is responsible for the costs associated with transporting the merchandise to the port of destination. This includes the cost of the merchandise, cargo insurance during transportation, and the cost of ocean transportation itself.

Buyer Responsibilities:

Payment for the goods. Those expenses of arrival, or at destination. Payment of customs clearance at destination.

Risks and costs

Risks: Until the moment of delivery, the seller assumes all risks of loss or damage caused to the merchandise.

Costs: All transportation costs to the buyer's port of destination, insurance from shipment to final delivery.

Key points:

Goods are transported by sea or inland waterways only, while CIP means that you can use any mode of transport, including air transport, trucks, railways, etc.

Suitable for all modes of transport:

The CIF incoterm or “Cost, Insurance and Freight” is exclusive to maritime transport.

The CIF cannot be used for air transport. The CIF is only used for sea and river transport. Buyers and sellers who wish to use CIF for air shipments can replace CIF with CIP, which stands for transportation insurance paid to destination.

You can insure 100% or 110%, it must be reviewed before the policy allows the country (there are some that do not accept them due to the current situation (war/among others).

CIF summary:

It provides a structure that defines the responsibilities and obligations of buyers and sellers in an international trade transaction, allowing both parties to understand their roles and ensuring that goods arrive safely at their destination.

We hope that now you can learn more about everything related to Incoterms 2020. And if you need help with your international freight transportation and air import, we will be happy to help you.